Main Menu

WHAT WE DO

Main Menu

Main Menu

The solution to foreign dependency

In today’s post-Covid world of strained supply chains, food security is further threatened by a 25% world supply shortage caused by sanctions against Russia and Belarus. The US imports 95% of its Potash requirements from Canada and it is critical that American potash production be brought on-line to ensure long-term National Food Security. The Sage Plains Project could be the largest potash deposit closest to production within the continental US to improve regional and national supply chain resilience and reduce delivered cost to market. Pricing from Canada to various US market regions include high freight and storage costs between $150-225/ton.

There are potash deposits in the US that have historically provided some domestic supply, mostly located in New Mexico, Michigan and Utah. According to the most recent figures available from the USGS⁵, for 2020, domestic production has remained stable over the past several years even as price (and profitability) has risen. Existing producers are limited by complex geology, and production constraints and new sources must be developed.

Establishing new mines in known potash-rich areas is a good place to start. The USGS estimates there are about 7 billion tons of potash that is potentially accessible in the US, with about 2 billion tons located in the Paradox Basin that covers portions of southeastern Utah and southwestern Colorado.

PARADOX BASIN CONTAINS MORE THAN 25% OF US POTASH, YET ONLY PRODUCES 3.5% OF US POTASH DEMAND

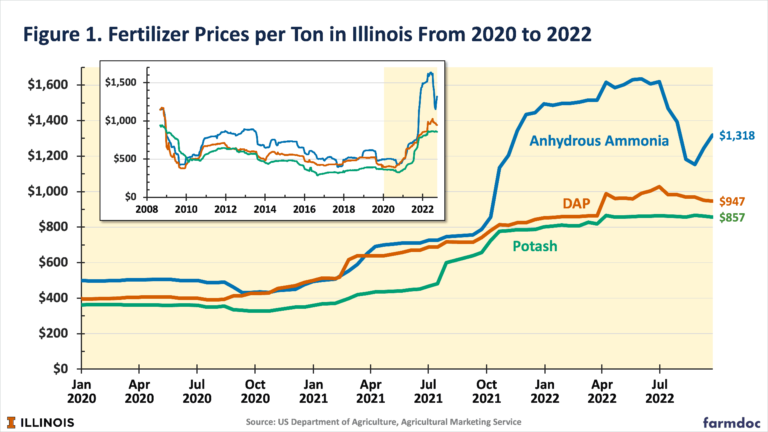

Potash prices have risen dramatically due to the sanctions against Russia/Belarus, but have adjusted lower due to increased inventories. The Potash market is expected to register fluctuating growth trends in the long term, while inflation and supply chain concerns are expected to continue in 2023.* One area that needs to be watched closely in the U.S. in the early part of 2023 is fertilizer logistics. The all-important Mississippi River continues to operate at extremely low levels because of drought lowering river levels. Reports from the river say barges are operating somewhat lighter to negotiate the shallower river. This could affect both nutrient supply and price.**

*2023 Potash Market Outlook Report

**2023 Potash Outlook Sees More Supply, Lower Prices

Planting economics for growers must consider many factors: previous and future commodity prices, fertilizer costs, soil analysis etc. Depending on these inputs the decision to skip fertilizer for a season could be a reality. The major foreign producers only supply a “one size fits all” product, a standard potassium content blend. Having a regional US based producer with the flexibility to supply varying blends of potassium could be an important factor in managing seasonal planting unit costs when potash prices are up. Similarly, varying climate zones and soil conditions may benefit from lower potassium content thereby reducing unnecessary fertilizer run-off.

Importance of POTash

Maintaining crop production and boosting yields requires 3 essential nutrients: NPK (Nitrogen, Phosphate, Potassium). Potassium(K) is key in plant nutritional composition. Both humans and animals require high levels of K in their diet to function properly. Humans get their K requirements by consuming fruits, vegetables, grains and animal protein. The animals that we rely on for food also get their K requirements from feed crops (alfalfa hay, corn stover, and small grain cereals). Most of the potassium found in soils, is tied up (and insoluble) as feldspar and mica and unavailable to the plant, the minimal available fraction is found in soil solution.

Key roles of potassium in plants:

- Facilitates the translocation of water, carbohydrate and other nutrients within the plant

- Activates functional enzymes and is important for photosynthesis

- Stimulates early root and shoot growth, enhances maturity, and promotes yield

- Promotes good water use efficiency in the crop, reducing drought stress and wilting

- For winter crops, K is very important in vigor, good stand resistance, and reduced lodging

- Inhibits plant disease

MANAGEMENT TEAM & DIRECTORS

Tim Mizuno brings industry-leading expertise from over a decade in senior leadership roles at Nutrien, the world’s largest potash producer. He was instrumental in developing and executing the strategy for an integrated network of six mines, increasing production to more than 14 million tonnes and supplying over 40 countries — accounting for 20% of global potash output. Tim is a Chartered Professional Accountant and holds a degree from the University of Saskatchewan.

With over three decades of experience, he specializes in financing junior mining and technology companies in both public and private sectors. As the founder and owner of Wrenswood Capital Corp for the past 20 years, he has focused on investing in and advising numerous start-ups and facilitating turnarounds. In 2012, he brokered a groundbreaking joint venture that financed the original Sage Plains project, covering over 100,000 acres of state and private mineral leases. This endeavor included acquiring seismic data and successfully drilling the Johnson 1 well, with the entire project costing $16 million.

With over thirty years of strategic operations experience, executive leadership, and business relationships in the North American fertilizer industry, he has grown up working across all areas of his family’s calcium, transportation, and fertilizer businesses, including Tiger Calcium. He has extensive experience spearheading the development of cost-effective, cutting-edge processes to produce the highest quality products at the lowest cost in the market. During his tenure, the output of the plants grew by 200%, ultimately leading to the business being sold at nine times EBITA. He possesses exceptional leadership and employee retention skills, having led teams of over 500 employees. He is a proven leader in developing strong, mutually beneficial relationships within the communities in which he operates.

Senior VP of Ivanhoe Mines and Ivanhoe Capital for over 25 years.

Substantial background in organizing complex transactions in both public and private markets and handling detailed negotiations at a senior level.

Director of Equity Capital Markets at Jardine Fleming in Hong Kong (later J.P. Morgan).

Gordon Ellis P.Eng (retired).

Over 50 years of involvement in the mining industry and resource development.

Multiple senior management and director roles in public companies and a multi-billion-dollar ETF fund.

MBA in International Finance.

Chartered Directors designation from The Director’s College (a joint venture of McMaster University and The Conference Board of Canada).

Past member of the Society of

Exploration Geophysicists (SEG),

Canadian Institute of Mining and Metallurgy (CIMM), Association of Professional Economists of BC (P Econ), American Institute of Mining Engineers (AIME).

Founded and led to strong profitability as a manufacturing and distribution leader in the pet industry before organizing a buyout by the multibillion-dollar German manufacturer.

Global Co-Chairman of Mining at DLA Piper. Practicing Senior Partner at DLA Piper, specializing in securities law, corporate finance, M&A, mining law, and related corporate transactions. Recognized as a leading Canadian lawyer in global mining and a former board member of TSX and NYSE listed companies. Represented Sumitomo Metals Mining Co. in its US$1.4B construction decision to build the Cote Gold Project in Ontario, Canada, with JV partner IAMGOLD Corp. Awarded Best Lawyers in Canada for Mining Law (2016–2023), Natural Resources Law (2010–2023), and Securities Law (2014–2023).

Clark Sazwan, the former director and controlling shareholder of Tiger Calcium Services Inc., Tiger Tanklines (2011) Ltd. and Keg River Chemical Corp. As a second-generation mining industry expert, Mr. Sazwan is now an independent consultant with over 40 years of experience in the agriculture and natural resources sector. He brings extensive knowledge and industry experience across the mining value chain to Sage Potash. His decades of experience in the agricultural industry and expertise in rail and truck transportation provide the Board with a critical perspective to further Sage’s development in the Paradox Basin. Mr. Sazwan's experience includes product development and construction/project management of pipelines, processing plants, and wells.

Mr. Smalley provides legal services for financing private and public companies, serving as director of numerous capital pool companies listed for trading on the TSX-Venture Exchange. Mr. Smalley provides financing, business strategy advice, and corporate, commercial, and securities legal counsel.

Mr. Reum has a strong executive corporate finance track record of leading high-growth start-ups and large international partnerships from development to production stages across construction, mining, alternative energy, forestry, and military industries. Mr. Reum most recently served as CFO for Mavericks Micro Grids Inc., providing leadership and expertise in US IRA Investment Tax credit financing and carbon credit modeling.